So I recently terminated my Investment Linked Policy (ILP), in order to provide $$$ during my upcoming sabbatical.

This ILP was started 17 years ago when I was still a young man.

From time to time I recorded the surrender value and how much I paid thus far, in order to figure out the returns. The returns here are calculated using the fv() function in Google Sheet and is equivalent to CAGR or time-weighted rate of return.

The maximum return was only 4% in 2018!!

What is more, during the Covid-19 recession of 2020 the returns were 0%.

The returns were disappointing, to say the least. Hence I decided to terminate the policy while the returns were still positive at 1.9%.

This is also taking into account that there is more and more talk of an upcoming recession in 2023, such as those below:

https://www.cnbc.com/video/2023/04/14/singapore-cant-avoid-a-recession-economist-says-.html

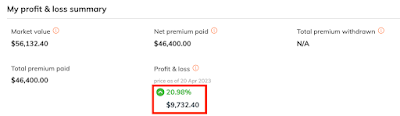

I will also share something which I believe is a totally inadequate effort on Income's part. In the portal, they only shared the simple returns but not the time-weighted returns. This is totally inadequate. Folks not versed in finance will believe their returns are great from the below, which shows 20.98%. They will think: Oh! Better than bank returns! That is wonderful!

In actual fact, after taking into account compounding effects, the returns are merely 1.9%...

As a newbie to cryptocurrency, I lost a lot of money up to $170,000 I would like to express my gratitude to Expert Bernie Doran for their exceptional assistance in recovering my funds from a forex broker. Their expertise and professionalism in navigating the complex process were truly commendable. Through their guidance and relentless efforts, I was able to successfully retrieve my funds of $170,000, providing me with much-needed relief. I highly recommend him on Gmail - Berniedoransignals@ gmail. com , to anyone facing similar challenges, as their dedication and commitment to helping clients are truly impressive. Thank you, Bernie doran, for your invaluable support in resolving this matter.

ReplyDeleteSingapore’s leading banks DBS Group (SGX: D05), OCBC Ltd (SGX: O39), and United Overseas Bank Ltd (SGX: U11) have all delivered a robust set of results.

Despite pressure on the net interest margin, loan growth and non-interest income (Non-II) more or less offset the drop, resulting in all three banks reporting higher total income for the quarter