If you trade the US market, you may have heard of the term 'S&P500 Dividend Aristocrats'.

Dividend aristocrats are a group of companies that have consistently increased their dividends for at least 25 consecutive years. They are a subset of dividend-paying stocks, which are companies that pay out a portion of their profits to shareholders in the form of dividends.

To qualify as a dividend aristocrat, a company must meet the following criteria:

- Be a member of the S&P 500 index.

- Have increased its dividend for at least 25 consecutive years.

- Have a market capitalization of at least $3 billion.

- Have an average daily trading volume of at least $5 million.

Dividend aristocrats are generally considered to be safe, long-term investments. They have a history of increasing their dividends, even during difficult economic times. This makes them a good option for investors who are looking for income from their investments.

I wonder if there were any companies listed on the Singapore Stock Exchange that managed to increase their dividends for the last 10 years.

I couldn't find any that increased its dividends for the last 10 years, but I did find some companies that did not decrease their dividends (ie. they maintained the same dividend as the previous year).

Here they are:

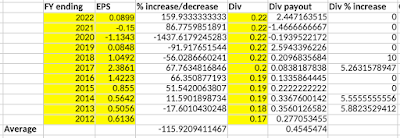

HKLand

HKLand has maintained its dividends at $0.22 for the last 5 years. It has not reduced its dividends, but there is no increase either!

The growth in EPS, however, is not good. There were negative EPS in 2021 and 2020.

Micromechanics

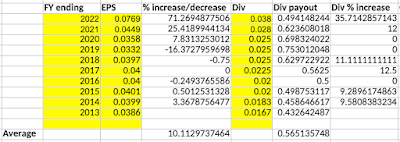

Raffles Medical Group

On average, over the last 10 years, the EPS growth is +10.1%, and the dividend growth is +10.0%.

SGX

On average, over the last 10 years, the EPS growth is +4.7%, and the dividend growth is +1.7%.

Hope this helps you in your trading journey.

No comments:

Post a Comment