To better understand the differences among the Roboadvisors, I decided to looker deeper at their investment strategies.

Where available, I attach screenshots of where this information is available in the mobile/web app.

So I use 3 Roboadvisors:

- Endowus - General Wealth Accumulation 80-20

- Syfe Stockpile

- Stashaway General Investing

Equity-Bond Allocation

Endowus - General Wealth Accumulation 80-20

Syfe Stockpile

Stashaway General Investing - It does not have equity-cash breakdown readily available.

Here are the pie charts of the equity-cash breakdown:

Asset Allocations

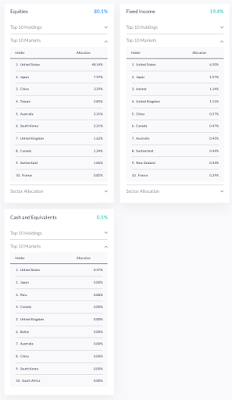

Endowus - General Wealth Accumulation 80-20

Syfe Stockpile

Stashaway General Investing - this provides the nicest visualization here.

Here's all the Roboadvisors in one chart:

Interestingly, Syfe Stockpile has more US equities than International equities but it is the other way around for Stashaway.

Geographical Allocations

Endowus General Wealth Accumulation 80-20

Syfe Stockpile - no readily available info or visualization

Stashway General Investing

Here are the pie charts of the geographical allocation breakdown:

Seems all 3 are concentrated in North America, Asia and Europe, in this order.

If you are interested to try out these roboadvisors, feel free to use my referral codes below:

Endowus: HDOJH

Syfe: SRPSL4GWK