Singapore is holding its Presidential Elections on 1 Sep 2023, and a few presidential candidates have popped up.

The contenders are Mr. Ng Kok Song (former Chief Investment Officer of GIC), Mr. Tharman Shanmugaratnam (former Deputy Prime Minister of Singapore), Mr. George Goh (Entrepreneur, CEO Harvey Norman Ossia), and Mr. Tan Kin Lian (former NTUC Income CEO).

Who will win the race is still unclear. However, out of the 4, I will think Mr. Ng Kok Song, former GIC Chief Investment Officer, is the most interesting one, offering a breath of fresh air.

I have watched a number of his interviews and am impressed by his clarity of thought and his eloquence. He is able to explain complicated things in simple terms. I learned a lot by listening to him speak.

Truly, he is the closest we have to a Warren Buffett in Singapore.

Below are some of his sharings which I feel are good learnings.

How to become a good investor

1. Take a long-term investment horizon e.g. GIC takes a 20-year rolling average, for individuals he recommends a 40-year horizon

2. Know what is your risk capacity - don't invest with money you cannot afford to lose. Must be prepared with a mark-to-market loss ie. need holding power.

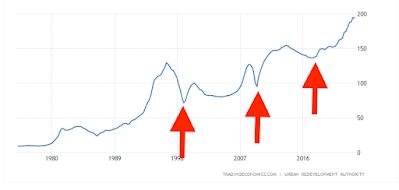

3. Have realistic expectations of rate of return - e.g. SP500 returns a nominal rate of return of 7-8%. If inflation is 2%, then real returns are 5-6%. Don't expect 12% returns. Note that 5-6% returns are nothing to scoff at - 5-6% returns compound over time to deliver big returns.

4. Minimize transaction costs - don't erode your compounding power with 1-2% transaction costs. Don't jump in and out of the market. Invest steadily in low-cost index funds.

What does GIC Invest In

Stocks - both developed and emerging markets

Bonds

Private equity

Real estate

Infrastructure

Why are our national reserves important

1. For use in times of war to liberate/rebuild the country

2. Financial crises such as recession, covid to save jobs

3. Backing behind the strength of the Singapore dollar - important because it helps us bring down the cost of living especially in times of inflation - this is related to financial defense

Views on SP500

The American stock market is now 70% of the global market cap, but the American economy is only over 20% of the global economy. This is a sign that it is at an inflated level, pushed up by tech stocks and recently by AI and ML stocks.

So need to avoid overconcentration on SP500. Suggest to buy MSCI World Index to achieve diversification.

Views on Market

Investing is to anticipate changes in what is already discounted in the market.

There are 4 key variables in investing you need to watch out for:

1. Economic growth or growth in EPS

2. Inflation - a rise in inflation is bad for stocks or bonds

3. Risk premium - are people more risk on or risk off

4. Interest rate - high the level of interest rates are bad for stocks

Take for example China - there is a lot of pessimism in China now due to Ageing population, and the US challenges in the tech sector. But sometimes people can get over pessimistic. Inflation is low in China. Risk premium in China - people are scared. Americans are reluctant to invest in China because of career risk. For China, it could get worse or it could get better. Across the world, interest rates are more or less set by the US market. In the bond market, people are expecting interest rates to fall. This is because the 10-year interest rate is at 4.5%, but the short-term interest rate is higher at around 5% - this is the inverted yield curve.

The Formula for Keeping Healthy

SHIELD acronym:

S - sleep

H - how to handle stress: Meditate

I - interaction/relationship/friends

E - exercise

L - learn

D - diet. Low carb/low sugar, plenty of fruits and vegetables

You can watch the entire Youtube video here: https://www.youtube.com/watch?v=coikUfKFH2M