I was having lunch with my colleagues a while back and we were talking about property in Singapore. One of my colleagues claimed there was no crash in Singapore property prices before.

How wrong he was!

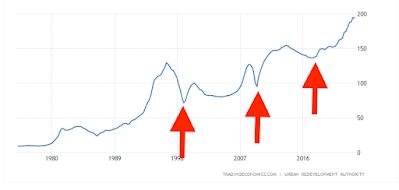

Refer to the chart below, there were at least 3 property declines in relatively recent times.

1998 Asian Financial Crisis

Drop of 46%

Decline lasted around 3 years

2008 The Great Recession

Drop of 27%

Decline lasted around 1 year

2013 Cooling Measures

Drop of 10%

Decline lasted around 5 years

Meanwhile, private home prices fell by 0.4% in Q2 2023, following a 3.3% gain in Q1 2023. This is the first fall in the last 3 years.

URA also said price momentum is easing across all market segments.

This fall in prices comes after several rounds of property cooling measures since Dec 2021, including an increase of additional buyer's stamp duty (ABSD) in Apr 2023 (from 30% to a whopping 60% foreigners, from 17% to 20% for Singaporeans buying second property).

Meanwhile, SIBOR rates have reached highs since Dec 2022. No doubt the high-interest rates will put off some folks wanting to purchase property using loans.

It may take a few more months before the full effects of the cooling measures can be observed.

No doubt property prices will decline again. Until then, prepare ammo.

References

Singapore Property Cooling Measures

Singapore Private Home Prices Fall Q2 2023

Home Buyers Undaunted by Cooling Measures

No comments:

Post a Comment