So I was chatting with my wife who is not really an advocate of the FIRE lifestyle.

Her reasoning is as such:

There is no point saving up so much if you can't enjoy it in the end.

She cited the example of an uncle who suffered from dementia and died with $1 million in his bank account. It seems that this uncle worked hard his entire life but was not able to enjoy the fruits of his labour. He also has no offsprings who can inherit his wealth.

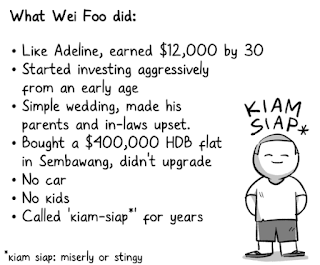

This story to me, is the perfect example why we need to pursue the FIRE lifestyle. With the FIRE lifestyle, one can retire much earlier e.g. 40, 45, 50, or 55 and enjoy the fruits of his labour.

Undeterred, she raised another point.

There is nothing much to enjoy about the FIRE lifestyle. You cannot eat at restaurants, you cannot travel, so what is the point even if you are able to achieve FIRE?

Do not be mistaken, actually FIRE does allow one to eat at restaurants and travel. But you have to build this into your budget, so it simply means you will need a bigger sum of money to achieve FIRE, which in turn means it will take longer for you to FIRE. There is nothing wrong with that, it is simply a matter of choice. Nobody is saying you have to FIRE by 40. The retirement age in Singapore is currently 63, you can FIRE at 62 if you want. Imagine! You have earned yourself an opportunity to retire and escape from your soul-sapping work one year earlier. Is this not a worthwhile pursuit in itself? Is this not worth fighting for?

In a span of a few days, CNA published another article about FIRE:

https://www.channelnewsasia.com/singapore/fire-movement-financial-independence-retire-early-2881076

From the article, here are some crtifcisms of FIRE:

Despite achieving FIRE, these individuals “found no satisfaction in their accumulated wealth”, suggesting that “frugality can diminish the joys of life greatly”, he noted.

You have to understand what your priorities are. If you plan to travel to far-flung places yearly, then probably FIRE is not for you. On the other hand, if you are fine with travelling to nearby countries, and yet have the time to pursue your passions, then FIRE is worth it.

“The most common criticism I get is that life is uncertain, and one should enjoy what money can do, while you still can,” he said.

This is the typical YOLO mindset which got a lot of youngsters into trouble later on in life. There is uncertainty, but life is a game of probabilities. You have to plan for the scenario with the highest probability for you. For most, it is living to your 80s.

“But what you cannot get back is time. What you are giving up to save the money … is hours with your children, with your friends, with yourself. If you are willing to give up that time, then I think it’s a perfectly sound decision. For most people, it depends on what their priorities are.”

This is nonsense! The whole purpose of FIRE is to allow yourself more time to pursue what you have always wanted to do.

What do you think? Let me know in the comments below.