So I recently terminated my Investment Linked Policy (ILP), in order to provide $$$ during my upcoming sabbatical.

This ILP was started 17 years ago when I was still a young man.

From time to time I recorded the surrender value and how much I paid thus far, in order to figure out the returns. The returns here are calculated using the fv() function in Google Sheet and is equivalent to CAGR or time-weighted rate of return.

The maximum return was only 4% in 2018!!

What is more, during the Covid-19 recession of 2020 the returns were 0%.

The returns were disappointing, to say the least. Hence I decided to terminate the policy while the returns were still positive at 1.9%.

This is also taking into account that there is more and more talk of an upcoming recession in 2023, such as those below:

https://www.cnbc.com/video/2023/04/14/singapore-cant-avoid-a-recession-economist-says-.html

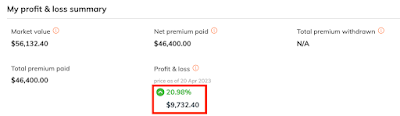

I will also share something which I believe is a totally inadequate effort on Income's part. In the portal, they only shared the simple returns but not the time-weighted returns. This is totally inadequate. Folks not versed in finance will believe their returns are great from the below, which shows 20.98%. They will think: Oh! Better than bank returns! That is wonderful!

In actual fact, after taking into account compounding effects, the returns are merely 1.9%...