GrabFood delivery!

And believe it or not, it has worked out so unexpectedly well I had to write a post.

Here's what I enjoy about it:

- Exercise my legs - After a long day of sitting in front of the computer, it feels really good to be able to go out to get some fresh air and exercise my legs, and at the same time get paid while doing it

- Rest my eyes - If I stay at home I will be staring at more screens (TV/mobile/laptop)

- Explore new restaurants - For example, I discovered 2 new Acai shops which are really popular (and really expensive)

- Explore new areas - For example, I found a nice shortcut path between 2 areas in my town, which I previously thought had no accessibility between them

- I have always been interested in work where there is a direct and obvious link between effort and reward. Most office jobs are not like this, where you can put in a lot of effort at work, but see no increase in performance bonus when the time comes. For jobs like delivery, the more hardworking you are, the higher reward is guaranteed 100%.

I know there is some stigma associated with food delivery, for example, rude customers and all, but the experience so far has been really positive. Everyone has been really polite, though I did encounter the occasional security guard that is really fussy about where to park your bike even when raining but that's about it.

Having said that I need to add that I am not doing this for a living, this is more for fun. I only do 1-2 trips at night after my kids' bedtime. I also have the choice of not doing it if I am tired or when it is too hot/too rainy. I understand that doing this job for continuous full days can be very tiring and unpleasant.

Otherwise, it is a great way to exercise and earn some money at the same time!

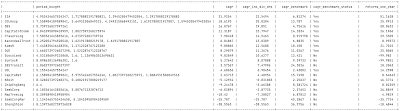

My earnings from 1 Aug till now are shown below: