I heard a rather interesting point about GST by Prof. Paul Tambyah at his rally:

https://www.youtube.com/watch?v=ormN-qUD46M

Go to 2:31:50.

I quote him below:

The whole thing about GST is that it is really a regressive tax*.

The median income in Singapore is about 11,000 and the average household in Singapore spends about 6000 in Singapore for routine expenses.

So 6000 you pay 9% GST it ends up about 530 dollars, and that is actually 4.7% of your income.

In contrast, you take the average minister earns 128,000.

Even assuming he spends a luxurious lifestyle, spending 5 time that of the average Singaporean, 30000 a month, they still pay only 2600 in GST and this represents only 2% of their income.

So basically what I'm trying to say with all that math is that the average person pays a far higher proportion of their income in GST than a high income person like a minister, and this is clearly unjust.

And this is what we are trying to do, which is to get rid of GST for essential items and to bring the GST down to at least 7%, maybe 5%.

And we have done our sums - the actual savings or the reduction in income is actually even less than the budget surplus that has been projected now.

This is a rather fresh point for me, since all I've heard so far about GST is that the PAP's view that the GST taxes the rich by taxing people if they spend more.

However, this view omits the high income of the rich. It will be a more substantial analysis if the high incomes of the rich are factored into the analysis.

Going by his logic above, I ran the numbers in my spreadsheet and his numbers are correct ie. the average household does pay a higher percentage of their household income in GST compared to the ultra-high-earners (almost double).

What if we reduce the GST to 5%? While GST payment is definitely reduced, the problem I mentioned above is still there. In terms of percentage of income, the ultra-high-earners still pay half that of the average household.

Now then, for this to be fairer, such that the ultra-high-earners pay as much as or more in terms of the percentage of their household income in GST, how much more should they pay if not 5 times more?

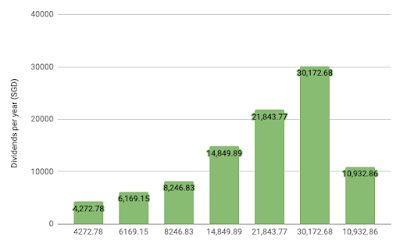

It turns out they need to spend 12 times more than the average household (see below), or 72k a month.

In other words, ultra-high-earners need to spend 72k a month for GST to hit them as hard as for the average household.

Granted, we are not living in a fair world.

*What is a regressive tax?

A regressive tax is a type of tax where lower-income individuals pay a higher percentage of their income compared to higher-income individuals.[ChatGPT]