Since my previous post on calculating my returns from investing in STI over the last 10 years, the STI had a good run.

Also, recently on 15 Jul 2024, I collected $2,478.05 in dividends.

So I decided to write a feel-good post about my returns from investing in STI, which should be higher than the 4.4% CAGR reported in my previous post.

I have collected $20,199.67 in dividends over the last 10 years. I started DCA on 24 Apr 2014.

So how much returns has that netted me?

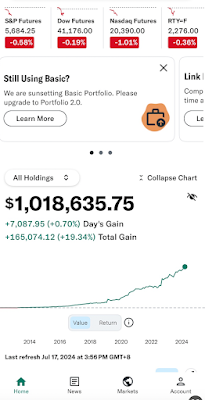

Without dividends included, I achieved a CAGR of 2.2%. With dividends included, my CAGR increases to 5.3%! This CAGR is computed using the FV() formula in Google Sheets.

Results are as of 16 July. STI has fallen a bit since then, I am glad I captured this moment.

I also share below some quotes about STI I collected over the years, from online articles, newspapers etc. Unfortunately, I did not save the URL link for most of them.

On STI returns:

- For the record, long-term returns of 8% aren’t exactly unrealistic given how the SPDR Straits Times Index (SGX: ES3), an exchange-traded fund tracking Singapore’s stock market barometer the Straits Times Index (SGX: ^STI), has a compounded annual return of 8.45% from April 2002 to Nov 2013 (a period encompassing more than 11 years that contained a dreadful global financial crisis, no less) after accounting for reinvested dividends.

- Singapore’s stock market, as represented by the Straits Times Index (SGX: ^STI), has increased in price at an annualized rate of around 5.2% over the past 26 years since the start of 1988

- Richard has compounded money at 24.55% annualized for the last 30 years

in the USA. In comparison, one of the most widely followed market

indexes there, the S&P 500, as compounded at ‘only’ to 9.4% in the same period. Richard also puts our local stock market to shame as the Straits Times Index (SGX: ^STI) in Singapore had only grown at an annualized rate of 5.1% over the past 26 years since the start of 1988.

- Without dividends, over the ten years ending Feb 2014 the SPDR® STI ETF

gained 63.9% in Net Asset Value. Including dividends, the 10-year return

came to 123.56%. This meant that over the past 10 years, with dividends

included, the SPDR® STI ETF returned 8.4% on an annualized basis.

- For comparison, the Straits Times Index (SGX: ^STI) has a

compounded annual return of 5.2% over the past 26 years since the start

of 1988 at its current level of 3,194 points. So, a long-run return of

6% is not something that’s out of this world.

- Since January 1988, the Straits Times Index has appreciated from 830

points to almost 3,300 points today. That equates to a rise of around

268% or roughly 5% a year. Now add on 3% for dividends and the resultant

annual total return is about 8%.

- For the less risk-averse, one could also possibly look into investing in the SDPR Straits Times Index ETF (SGX:ES3) as an easy way to own a basket of different shares. Over the

decade ended 31 May 2014, the exchange-traded fund has generated

annualized returns of 9.57% if dividends had been reinvested, turning a

$10,000 investment into $24,491.

- That’s especially so when considering that the SPDR Straits Times Index ETF (SGX: ES3), an exchange-traded fund that tracks the Straits Times Index (SGX: ^STI), has clocked total returns of ‘only’ 137.9% (or 9.05% per year on average) in the 10 years ended 30 June 2014.

- Between 11 April 2002 and 31 August 2014, the SPDR STI ETF (SGX: ES3), an exchange-traded fund which aims to mimic Singapore’s market barometer the Straits Times Index (SGX: ^STI), has delivered annualized capital gains of 5.35%.

On STI returns in 2018:

- For the 10 years ending 2018, the STI generated annualized total returns of 9.2 percent, thanks to the reinvestment of dividends.

- Without reinvesting dividends the STI's annualized return over the 10 years would have been 5.7 percent. The Straits Times Index (STI) generated a 6.5 percent decline in total returns in 2018

- The Straits Times Index (STI) generated a 6.5 percent decline in total returns in 2018

- It added that the non-weighted average return of the 30 STI constituents for last year was a decline of 8.4 percent.

Above extracted from

https://www.channelnewsasia.com/news/business/sti-sgx-singapore-stocks-total-returns-2018-11083026

The quotes above are interesting. Generally, for STI in the 10 years that ended in 2014, returns are 5% without dividends and 9% with dividends. Similar to STI in the 10 years that ended in 2018.

So why did my STI portfolio only manage 5.3% with dividends in the 10 years ending 2024?

I can only attribute this to the STI losing steam ever since the Great Recession of 2008. In fact, STI has not even reclaimed the high of 3900 around Oct 2007.