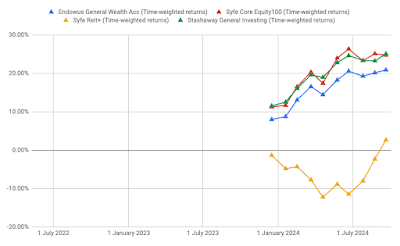

I felt it would be good to track the returns regularly since they fluctuate occasionally depending on the stock market.

Here are the movements for this month. Most of my funds reached all-time highs. This is because in the month September, the Fed lowered the interest rates (finally!) by 50 basis points to the range of 4.75%-5%.

For the Robo-Advisors, it did go up but the gains were not as significant as my pure stocks portfolios. What is relieving is that Syfe Reit+ fund is finally positive.

Additionally, I think it will be interesting to see the breakdown of my portfolios in percentages (below). There is a component 'X' which I do not want to disclose for now. The concentration of 'X' is now 12.4% but is still too high.

Market events over the last month:

The Fed lowered interest rates by 50 basis points to 4.75%-5%. This is the first rate cut in 4 years. With this rate cut, Reits and Bonds are expected to rise. However, bank stocks will fall. How much each segment will rise or fall is unclear though, as some say the interest rates will not go to zero.

On the home front, SG stocks rose to 2007 highs. This is after a whooping 17 years!

The authorities finally seem willing to do something to revitalize the SGX laggard.

Examples include building Singapore as a leading real estate investment trusts (Reits) hub by identifying a market need and creating a supportive regulatory ecosystem for such growth. The Republic today holds the largest Reits market in Asia ex-Japan, Chee highlighted.

This is following a barrage of opinion pieces in the media suggesting the authorities to do something to revitalize the stock market, such as this one:

Onwards!

No comments:

Post a Comment